เครื่องดักยุงมีกี่ประเภท ซื้อแบบไหนใช้งานได้ผลดีกว่า

เครื่องดักยุง ถือว่าเป็นอุปกรณ์กำจัดยุงชนิดหนึ่งที่นิยมใช้กันมากขึ้น โดยเฉพาะ ...

สาระชวนรู้ สำลักอาหาร อันตรายถึงชีวิต ต้องได้รับการช่วยเหลือทันที

การ “สำลักอาหาร” เป็นเรื่องเล็ก ๆ ที่สามารถก่อให้เกิดอันตรายถึงชีวิตได้ ...

สูตรน้ำจิ้มลูกชิ้นรสเด็ด ทำกินเองอร่อย ทำขายกำไรดี

สำหรับใครที่มีลูกชิ้นเป็นเมนูโปรด แต่ไม่อยากออกไปตากแดดซื้อที่ร้าน ...

7 ประเภทชา ดื่มเสริมสุขภาพ ห่างไกลโรค

บรรยากาศฝน ๆ แบบนี้ หรือแม้แต่ช่วงที่อากาศเย็น ๆ การได้ดื่มอะไรอุ่น ๆ อย่าง ...

Latest NewsView More

มาริโมะคืออะไร เลี้ยงมาริโมะเพื่ออะไร พร้อมบอกวิธีเลี้ยงมาริโมะ

สำหรับใครที่เคยได้เห็นเจ้าก้อนกลมสีเขียว ที่นิยมเลี้ยงกันในหมู่วัยรุ่น หรือมักนอนแอ้งแม้งอยู่ในขวดโหลสวย ๆ หรือนอนขดกลมในตู้ปลา ...

ประคบร้อน ประคบเย็น ต่างกันอย่างไร

การประคบ และ การประคบเย็น คือ วิธีการปฐมพยาบาลเบื้องต้น สำหรับใช้บรรเทาอาการบาดเจ็บ หรืออาการปวด และการอักเสบที่เกิดจากกิจกรรมต่าง ๆ ...

5 ประโยคใดบ้างที่ลูกไม่ควรพูดกับพ่อแม่

วัฒนธรรมคนไทยให้ความสำคัญกับการกตัญญูต่อพ่อแม่ เพราะกว่าที่เราทุกคนจะเติบโตขึ้นมา ล้วนมาจากความเหนื่อยยาก อดทน ...

เครื่องดักยุงมีกี่ประเภท ซื้อแบบไหนใช้งานได้ผลดีกว่า

เครื่องดักยุง ถือว่าเป็นอุปกรณ์กำจัดยุงชนิดหนึ่งที่นิยมใช้กันมากขึ้น โดยเฉพาะ “เครื่องดักยุงไฟฟ้า” ยิ่งในฤดูฝนเป็นช่วงที่มียุงชุกชุม ...

สาระชวนรู้ สำลักอาหาร อันตรายถึงชีวิต ต้องได้รับการช่วยเหลือทันที

การ “สำลักอาหาร” เป็นเรื่องเล็ก ๆ ที่สามารถก่อให้เกิดอันตรายถึงชีวิตได้ ซึ่งเป็นสิ่งใกล้ตัวมาก ๆ สามารถเกิดขึ้นได้ทุกเพศทุกวัย ...

สูตรน้ำจิ้มลูกชิ้นรสเด็ด ทำกินเองอร่อย ทำขายกำไรดี

สำหรับใครที่มีลูกชิ้นเป็นเมนูโปรด แต่ไม่อยากออกไปตากแดดซื้อที่ร้าน หรือใครที่กำลังมองหาอาชีพอิสระ ...

Editors Pick

Categories

Popular

Newsletter

Subscribe to my email list and stay up-to-date!

BusinessView All

มาริโมะคืออะไร เลี้ยงมาริโมะเพื่ออะไร พร้อมบอกวิธีเลี้ยงมาริโมะ

สำหรับใครที่เคยได้เห็นเจ้าก้อนกลมสีเขียว ที่นิยมเลี้ยงกันในหมู่วัยรุ่น ...

เคยสงสัยไหม “ค่ากำเหน็จทอง” คืออะไร เราต้องจ่ายไหม ทำไมต้องเก็บ?

ในช่วงที่เศรษฐกิจดูไม่แน่นอน อะไรๆ ก็พร้อมจะดิ่งลงทุกเมื่อ ...

อุปกรณ์ป้องกันไฟฟ้าในบ้านที่ควรมีทุกบ้าน โดยเฉพาะช่วงหน้าฝน

ปัญหาจากการใช้อุปกรณ์ไฟฟ้าที่พบได้บ่อย โดยเฉพาะช่วงหน้าฝน หรือเวลาที่มีฝนตก ฟ้าร้อง ฟ้าผ่า คือ ไฟตก ...

อัพไลน์ (Upline) – ดาวน์ไลน์ (Downline) ต่างกันอย่างไร | แชร์ลูกโซ่ Forex 3D

ตอนนี้กระแสเรื่องการแชร์ลูกโซ่กำลังเป็นที่พูดถึงในวงกว้าง ...

วิธีเลือกซื้อแบตเตอรี่รถยนต์ พร้อมบอกเทคนิคการดูแลแบตฯหน้าฝน

หน้าฝนมาอีกแล้ว ทำให้หลายคนต้องขับรถฝ่าสายฝน และสภาพการจราจรหน้าฝนในเมืองไทยเป็นที่รู้กันดีอยู่แล้ว ...

FinanceView All

เคยสงสัยไหม “ค่ากำเหน็จทอง” คืออะไร เราต้องจ่ายไหม ทำไมต้องเก็บ?

ในช่วงที่เศรษฐกิจดูไม่แน่นอน อะไรๆ ก็พร้อมจะดิ่งลงทุกเมื่อ ...

อัพไลน์ (Upline) – ดาวน์ไลน์ (Downline) ต่างกันอย่างไร | แชร์ลูกโซ่ Forex 3D

ตอนนี้กระแสเรื่องการแชร์ลูกโซ่กำลังเป็นที่พูดถึงในวงกว้าง ...

TechnologyView All

เครื่องดักยุงมีกี่ประเภท ซื้อแบบไหนใช้งานได้ผลดีกว่า

เครื่องดักยุง ถือว่าเป็นอุปกรณ์กำจัดยุงชนิดหนึ่งที่นิยมใช้กันมากขึ้น โดยเฉพาะ “เครื่องดักยุงไฟฟ้า” ...

ทำไมขยะอาหารจึงมีปริมาณเพิ่มขึ้น เราสูญเสียอาหารไปเท่าไรในแต่ละวัน และการลดขยะอาหารช่วยแก้ปัญหาให้ยั่งยืนได้อย่างไร

ปัญหาใหญ่ที่ทั่วโลกจะต้องเร่งจัดการด่วน เพราะส่งผลกระทบเป็นวงกว้างต่อสภาพสิ่งแวดล้อม เศรษฐกิจ ...

อุปกรณ์ป้องกันไฟฟ้าในบ้านที่ควรมีทุกบ้าน โดยเฉพาะช่วงหน้าฝน

ปัญหาจากการใช้อุปกรณ์ไฟฟ้าที่พบได้บ่อย โดยเฉพาะช่วงหน้าฝน หรือเวลาที่มีฝนตก ฟ้าร้อง ฟ้าผ่า คือ ไฟตก ...

วิธีเลือกซื้อแบตเตอรี่รถยนต์ พร้อมบอกเทคนิคการดูแลแบตฯหน้าฝน

หน้าฝนมาอีกแล้ว ทำให้หลายคนต้องขับรถฝ่าสายฝน และสภาพการจราจรหน้าฝนในเมืองไทยเป็นที่รู้กันดีอยู่แล้ว ...

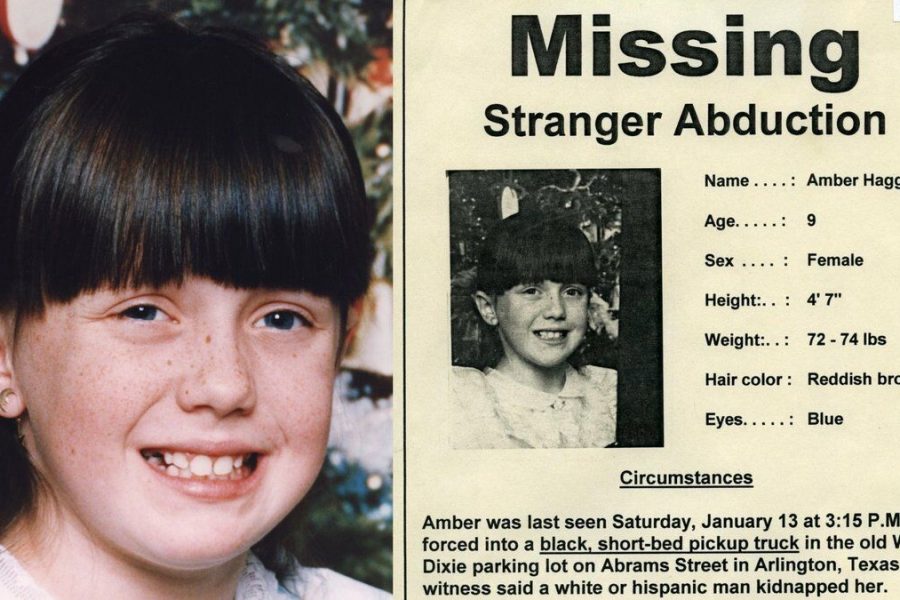

ระบบ Amber Alert คืออะไร ทำไมจึงต้องมีการผลักดันให้มีในไทย

ในที่สุด ระบบ Amber Alert ก็ได้ถูกผลักดันและเปิดให้ใช้ในประเทศไทยได้แล้ว เมื่อวันที่ 25 สิงหาคม 2565 ...